You have worked so hard to become debt-free in retirement and now that you have reached that dream you may be wondering what comes next? Follow our steps below to make sure you get the most out of this huge accomplishment!

When you’ve spent months or years clawing your way out of debt, you’re so overwhelmed by it that you can’t imagine what it’s like to be debt-free. And that makes it hard and even painful to think about what you’ll do without all that debt weighing you down.

But now you’ve done the hard work, achieved what seemed impossible, and killed off your debt. Congratulations! I know it wasn’t easy. Now let’s see what’s next. These are 7 things to do after becoming debt-free.

What You Will Learn:

- Enjoy the Accomplishment

- Identify the Reason You Went Into Debt

- Build a Big Emergency Fund

- Invest for Retirement

- Invest in Non-Qualified Accounts

- Save for College

- Consult a Financial Professional

Enjoy the Accomplishment

Debt can control so many aspects of your life. It controls your ability to do things like take a vacation, save for a home, move out of an apartment that has become too small, make repairs or improvements to your home, buy a more reliable car, save for your children’s education, and your retirement.

“Perhaps the best thing about being debt-free is the feeling of freedom.”

Debt doesn’t control your decisions any longer. You get to decide what to do with your money. The other overwhelming feeling that debt brings on is stress. Being in debt can literally keep you up at night and cause fights between you and your partner. That’s gone now too.

Take a few minutes to sit back and reflect on what you’ve accomplished and all of the good things that await you. And celebrate! Do something really nice for yourself, a good dinner at your favorite restaurant, a massage, or a weekend trip. You deserve it!

Identify the Reason You Went Into Debt

In some cases, the debt was no fault of your own. You may have had a medical issue or injury and unable to work, and had to rely on credit cards once your emergency fund ran out. But in plenty of cases, it was our irresponsible spending that plunged us into debt.

If that’s the case for you, identify why you spent the way you did so you can address it.

“Did you spend when you were bored, angry, sad, to get back at your partner?”

In some cases, you may need help to address your spending habits through a therapist or a program like Debtors Anonymous. You may need to take a financial literacy class. There are plenty of free programs online.

The most important thing you can do after becoming debt-free is to take whatever steps are necessary to make sure you don’t slip back into debt again. It’s been found that 8% of people who file for bankruptcy have filed at least once before, and repeat filers are responsible for 16% of all bankruptcy cases.1

Build a Big Emergency Fund

Having an emergency fund will go a long way towards making sure you avoid going into debt again. I recommend a small emergency fund of $1,000 even for those who have credit card debt. Now that you no longer have debt, your fund needs to be much bigger.

Before 2020, I generally recommended an emergency fund that would cover three to six months’ worth of essential expenses. After seeing the swift, sudden, and prolonged economic misery the pandemic caused millions of Americans, I now recommend nine to 12 months. It sounds like a lot, and it is, but it’s critical to the financial well-being of someone who just escaped years of debt and, really, everyone else too.

Invest for Retirement

You’ve lost perhaps years of growth potential on your money through investing. I won’t belabor it, you likely already know it and feel terrible. And there’s nothing you can do about it now. But the money you invest for retirement has to last possibly decades; it’s the money you’re going to live on.

“You need to do everything you can to make up for lost time.”

Opt into your employer’s 401(k) if you haven’t. Start maxing it out if you haven’t been, including catch-up contributions if you’re over the age of 50. Open an IRA and max that out, too, again including the catch-up contributions for those 50 and older. An HSA can be used as an additional vehicle for retirement saving, too, if you’re eligible for one.

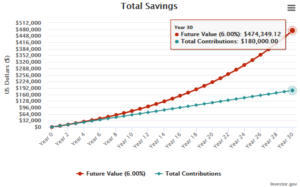

Investing $500 a month compounded annually with an assumed 6% rate of return would be over $470,000 after 30 years.

- This is a hypothetical example and is not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing.

Invest in Non-Qualified Accounts

If you’re still a few decades from retirement, consider investing in non-qualified accounts like index funds, ETFs, or opening a brokerage account for buying individual stocks if you are willing to do the research and due diligence required to pick individual stocks keeping in mind, that money should be your “Vegas” money, the money you are willing and able to lose.

Save for College

If you’re close to retirement and by close, I mean 40 and over and have little to nothing saved for retirement, cross this one off the list. The kiddos are going to have to work, get scholarships, grants, and student loans if they want to go to college.

It’s as simple as that.

I’m a parent, and I know we all want to do everything we can for our kids and have made countless sacrifices for them, financial and otherwise, over the years, but you can’t sacrifice your retirement for them. They have a lot longer to pay off their college loans than you have to save for retirement.

If you’re still decades away from retirement, consider opening a 529 Savings Plan for your child’s educational expenses. Even if that account won’t fully fund four years of college, every dollar you’ve saved for them is a dollar they don’t have to borrow.

Consult a Financial Professional

Set up a meeting with a CERTIFIED FINANCIAL PROFESSONAL™ professional . He or she can help you create a financial plan to be debt free in retirement and do all of the things on this list without any guesswork you might have to do trying to go it alone and without wasting that time that you don’t have.

A CFP can make sure you hit the ground running after becoming debt free.

If you would like to work with me Click Here.

Important Information

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All investing involves risk including loss of principal.

LPL Tracking #1-05147116