Sailing Smoothly Through Market Fluctuations

A client nearing retirement recently asked me how he should invest in retirement. He’s a few years away from retirement and had recently moved most of his money into stable value investments, basically cash, and was wondering if he should get back into the market. Sometimes, a picture is worth a thousand words, so a portion of this podcast is audio from a video I created for my YouTube channel. That’s what we’re talking about in episode 89 of the What the Wealth Podcast: sailing smoothly through market fluctuations.

Investing for Retirement

When you near retirement, it’s essential to start thinking about what you need to do in the next few years to prepare and how you’ll transition from having a career to being retired.

My client had moved to cash as he was worried about how volatile the market had been for the last few years, and he didn’t want to take much risk before he retired. His view was short-sighted, though. He was thinking about the next 18 to 24 months. I pointed out that he and his wife had to consider the next 25 or 30 years. Or even longer. With advances in health care, it’s not uncommon for at least one-half of a couple to live into their 90s or even 100s. What were his goals for that?

The couple wanted to travel, needed to buy a new car in the next few years, and wanted to leave a financial legacy for their children. But most of all, they wanted to enjoy a comfortable retirement and not worry about money.

Taking the Long View

One of my favorite personal finance websites is A Wealth of Common Sense. The site has excellent charts that simplify a lot of information perfectly.

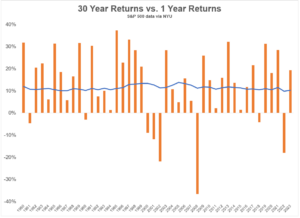

One such chart, the subject of my video and this podcast, shows the average returns on a year-to-year basis for the S&P 500 going back to 1980.

You can see that some years are up and some are down. Some years are up a lot, and some are down a lot. From year to year, the stock market can be incredibly volatile. But the chart shows why staying invested over the long term is important despite these fluctuations. The blue line shows the rolling 30-year periods: 1980-2010, 1981-2011, and so on. When we look at those periods, we see that the market averages around 9% to 10%.

One year, 2022, for example, can look really bad but zoom out. Over the long-term, there have only been eight down years in the last 33. So we can see that the returns are positive 75% of the time, the vast majority of the time.

And while the past is no guarantee of future returns, I’m an optimistic long-term investor. We are a consumption based economy; the more we spend and export, the more money companies have to grow and innovate, which increases share prices for investors.

And that is what the blue line in the chart reflects. It goes a long way to shape how we invest. Investing is a long-term proposition even as we near retirement because we potentially have decades left to live.

If you enjoyed the podcast, check out my new YouTube channels. The videos are short, walk and talks, where I take a stroll and talk about whatever’s on my mind. I also have a Paradigm Wealth Partners channel and have recently created an Instagram page.