Waiting Wisdom from Charlie Munger

“Big money is not in buying and selling, but in waiting,” said Charlie Munger.

Charlie was the Vice Chairman of Berkshire Hathaway. He passed away in November of 2023. This quote exemplifies the power of compounding and investor patience and how impactful it can be for investment performance. In episode 91 of the What the Wealth Podcast, we’ll discuss the real power of investor patience.

Investment Performance

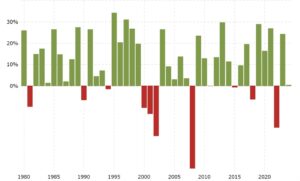

From 2000, to the end of 2003, there were 7 negative years in the market. There were two other years that were barely positive. It is impossible to forecast market performance with all the

geopolitical noise and events that may or may not be impactful. This chart by Macro Trends shows the great financial crisis, covid and most recently the 2022 decline when the Fed aggressively raised interest rates.

It shows that if you had allowed your investments to work for you long-term and stayed the course and waited as Charlie Munger advised, it would have had a positive impact.

The key is to stick with your investments and give them time to work for you.

For example, if you had invested $100,000 in 2000, that would have grown to be worth $488,000 by 2023. Over that period, the stock market returned 388% or just shy of 7% per year average.

The big money is in the waiting. Stay the course.

If you enjoyed the podcast, check out my new YouTube channels. The videos are short, walk and talks, where I take a stroll and talk about whatever’s on my mind. I also have a Paradigm Wealth Partners channel and have recently created an Instagram page.

Please share this episode with friends, family, co-workers or anyone who you think would find it helpful.