Tax Loss Harvesting

It’s the end of the year, and that’s when many people start thinking about tax loss harvesting. This strategy can be a great way to lower your tax liability, and you don’t have to be a high-earner to benefit from the strategy.

What is Tax Loss Harvesting?

Tax loss harvesting (TLH) is the act of selling an asset that has fallen in price from the price you paid for it on a cost-adjusted basis. You can use that loss to reduce your taxable capital gains and potentially offset up to $3,000 of your ordinary income.

If you paid $100 per share of Stock A and now that stock is worth only $50, you have a $50 loss per share. Selling that stock will harvest the loss.

We all know the goal of investing is to buy low and sell high, so tax loss harvesting seems to go against that investing principle, but that isn’t always possible. At any given time, some assets in your portfolio will go up, and some will go down. Harvesting losses gives us a silver lining for investments that are down in value.

A loss today can help offset gains when we make a profit on a sale in the future.

Proactive Tax Loss Harvesting

If you have non-qualified or non-retirement investment accounts, you can use tax loss harvesting to make a big difference in your tax liability. The issue for some investors is admitting they were wrong. Often, investing is more about behavior than it is picking the correct investment. Psychology and behavior biases are risks when it comes to investing, and even if you’re aware of it, those issues can be hard to overcome.

Investors sometimes hold onto bad investments hoping that they’ll recover so they can sell them and break even. Or they’ll keep them even longer, hoping they’ll be able to earn a profit. Another behavior that can prevent investors from reaping the benefits of TLH is the disposition effect. It explains investors’ tendency to sell assets that have increased in value while holding onto those that have dropped in value.

When Should You Tax Loss Harvest?

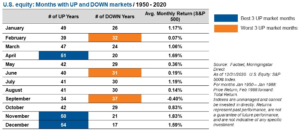

Many investors add tax loss harvesting to their end-of-year to-do lists, but the fourth quarter may not be the ideal time to do it. Morningstar had some interesting findings that might change our tax loss harvesting calendar.

Since 1926, based on the S&P 500, the U.S. stock market has been positive more than 70% of the time looking at calendar years. Based on monthly returns over the last 70 years, November has been the single best month for the stock market, while December has been the third-best month. We refer to this period as the Santa Clause Rally.

Waiting until late in the year means you’re tax loss harvesting during two of the worst months for it. Consider doing tax loss harvesting earlier in the year. You may save more money and have one less thing on your to-do list at the end of the year when many of us are busy with the holidays.

Is Tax Loss Harvesting Only for High Earners?

Definitely not! While it’s true that the higher your tax bracket, the more impactful TLH will be, it’s still beneficial for those in lower brackets.

An investor who has a marginal tax rate of 24% + 3.8% (net investment income tax) for a top federal rate of 27.8% who could harvest short-term losses that are equal to $3,000 could use that harvested loss to offset against short-term gains for a tax savings of $834 which is a considerable savings!

Common Tax Loss Harvesting Mistakes

Tax loss harvesting means you’re selling a security for less than you paid. What should you do with the money? Some investors sit on the cash for the required 31 days before rebuying the same security to avoid violating the wash sale rule. If the market is trending down, this is not a bad strategy. But if the market is strong, holding onto that money for 31 days means your money is not working for you.

If you buy a replacement security, it could have similar characteristics to the original but must be substantially different, again not to run afoul of the wash rule. “Substantially different” can mean fund share class, benchmark, or security type. If the two securities are too similar, the IRS may disallow the loss.

Too much TLH can be a bad thing. It isn’t something you need to do every time an investment loses value. What guides your decision on tax loss harvesting and all other investment decisions should always be your investment policy statement and investment strategy. Maybe an investment is just having a bad day or two. Let things play out, and give your investments time to work for you.

Tax loss harvesting isn’t wiping down the kitchen counters, something that needs to be done daily. It’s like cleaning out the closets, something that can be done less often, at the end of the month, quarterly, semi-annually, or once a year (But not necessarily at the end of the year!).

Listen to What The Wealth Episode #43: Tax Loss Harvesting

Listen as I walk you through the basics of TLH so that you can get a better understanding of how to implement it as a strategy. Taking a loss is not fun, but I’ll share how you can actually use it to benefit you in the future when cashing in on gains. You’ll also hear about the difficulties that get in the way of successful TLH and how important it is to be proactive.

What You’ll Learn In Today’s Episode:

- What TLH is.

- Why you would sell at a loss.

- How you can use this strategy to help minimize your taxable liability.

- Who would benefit from TLH.

- The difficulties in TLH.

- The disposition effect and how it affects your investing.

- The timing involved in tax loss decisions.

Resources In Today’s Episode:

- Jonathan Bednar: Email | Twitter | LinkedIn

- What The Wealth?! by Jonathan Bednar

If you have questions about tax loss harvesting, consult your CPA or financial advisor. If you don’t have either, you can work with me.