Retirement Savings

Many aspects of life can feel like a race, but a race is not always about who runs the fastest. And that’s especially true of retirement savings. The critical factor in saving enough for retirement is not how much money you put aside; it’s how long you put money aside. When it comes to the retirement race, time is of the essence.

What You Will Learn:

- A Tale of Twins

- Mary Versus Mark: Who Won the Retirement Race?

- The Magic Ingredient

A Tale of Twins Retirement Savings

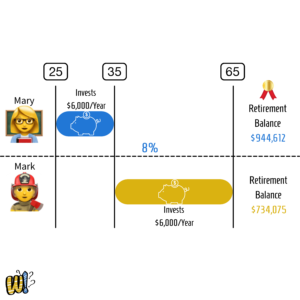

The best way to illustrate the importance of time when it comes to saving for retirement is to look at the tale of twins Mary and Mark.

Mary and Mark both started their careers at the same time and in the same place, the city of Seeds and Pines. Mary worked as a third-grade teacher, and Mark worked as a firefighter.

Mary opened a Roth IRA at age 25 and invested $6,000 each year for ten years until she was 35. After teaching for 40 years, Mary decided it was time to retire at age 65. Over the decade Mary was contributing to her IRA, she was earning 8% a year.

Mark also opened a Roth IRA, but he got a later start than Mary; he opened his account at age 35. Mark invested $6,000 a year from age 35 to 65, three decades. After serving his community with honor for 40 years, Mark decided it was time to retire at age 65. Over the three decades, Mark contributed to his IRA; he was earning 8% a year.

Mary Versus Mark: Who Won the Retirement Savings Race?

Mary invested $60,000 over ten years. Mark invested $180,000 over thirty years, $120,000 more than his sister. So who won the retirement race? Mark surely, by a mile, right? Let’s take a look.

Upon retirement, Mary was pleasantly surprised to see her retirement balance was $944,612. Mary had actively invested for ten years, and her money had grown in the market for forty years.

Upon retirement, Mark was less than pleasantly surprised (after comparing numbers with his sister) to see his retirement balance was $734,075.

“Mark invested twice as much money as his sister, and he had $210,537 less than she had when it was all said and done.”

Mary’s advantage was that early decade when she was investing, and Mark was not. Even twice the amount of money invested could not buy back that lost time for Mark.

The Magic Ingredient

When it comes to investing, in order to succeed, here is a list of things you don’t need:

- A lot of money

- A degree in finance

- A degree in anything

- A subscription to the Wall Street Journal

- Ever to have heard of the Wall Street Journal

- Insider information

Here is a list of what you do need:

- Time

That’s it. I’ve given away the secret.

“All you need to be a successful investor is time.”

Invest your money consistently starting early and leave it in the market to reap the benefits of compound growth powered by time. That’s how you win the retirement race.

Let us help you start your retirement race today!

If you would like to work with me Click Here.