The title of this podcast episode comes from a Harford Funds white paper that I recently came across. The last few years have been tremendously stressful in many ways and particularly stressful for investors. It seems like all of the news is bad, resulting in more than a little panic. But what can we do to avoid the panic which can derail our financial dreams?

If It’s Not One Thing, It’s Another

Recently the market has rallied from the lows in June, but now things are down again. It seems like a cascading series of events that never ends, the pandemic, decades-high inflation, rising interest rates with more likely to come, the war in Ukraine, and mid-term elections coming up. All this causes panic and worry, and it can be hard to resist the urge to play it safe and go to cash. But there is a price to that panic. This is from the whitepaper:

“In any crisis, ‘playing it safe’ to avoid losing your money can seem like the only rational strategy. However, in the past 60 years, we’ve seen repeating patterns of crises. Despite these crises, the market has been resilient. The Dow Jones Industrial Average rose from 679 points in 1959 to over 36,000 in January 2022. Regardless of the type of crisis, history shows that long-term investors who stayed the course through crises and didn’t lose sight of their financial goals have been rewarded.”

But we justifiably feel stress and anxiety when these crises happen. XYZ happens, and it triggers in us a need to do something. Inaction makes us feel helpless, which is a worse feeling than stress and anxiety! We want to take action, and we get that dopamine hit once we do. We did it; we took corrective action, and we took back control. But when we take action based on emotion, be it fear, anxiety, greed, or exuberance, it rarely works in our favor.

Always a Reason to Panic

Even putting aside extraordinary events like the pandemic and wars, which thankfully don’t happen every day or even all that often, there is always a reason to panic if you’re an investor. Between 1960 and 2021, the S&P 500 has seen seven 30%+ drops. These are the events that contributed to the panics:

- 1968-1970: Interest rates rose above 9%, and the war in Vietnam

- 1973-74: Middle East oil embargo and the Watergate scandal

- 1987: Black Monday when the Dow dropped 22% in a single day

- 2001: Dotcom bust, accounting scandals, and 9-11

- 2002: WorldCom collapsed, and Ford closed five plants

- 2007-08: Housing bust

- 2020: Pandemic

It’s easy to look back on all those events and see that the market is much higher now, but while they’re happening, it’s hard to see a recovery in the future. And no wonder.

Early in the pandemic, from March 16-20, 2020, Fox News saw its ratings increase 89% from the same period in 2019. In the same period, CNN saw an increase of 193% and MSNBC an increase of 56%. Those are huge increases; those extra views mean extra ad dollars. And people don’t watch the news for happy, feel-good stories. They watch when things are bad.

So the networks keep pushing out dire stories, and we keep watching. That feeds our panic and anxiety. And we start searching CNBC more often to see what all of this bad news means for the market and our portfolios. It’s a glut of information, and we don’t always know how to dissect it, so fear takes over.

The Risk of Mistake

When we’re anxious, we give more attention to negative information, and in times of stress, we actively seek it out. And we fear loss. The psychological pain of losing money is about twice as intense as the pleasure of gaining money. So we are more upset over losing $20 than we are happy to gain $100. And it shows.

By the end of 2021, total cash assets reached $17.2 trillion. That’s a lot of money. And it’s understandable. When we move to cash or cash equivalents, we don’t see those numbers dwindling like we see our portfolio numbers dwindling. But while choosing cash can make us feel safe, it’s a bad choice for long-term investors.

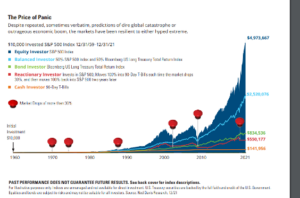

Let’s look at the results of five different types of investors during those seven 30%+ drops. Each person invested $10,000 between 1960 and 2021:

- Equity Investor: 100% in S&P 500 Index

- Balanced Investor: 50% in S&P 500 Index and 50% in Bloomberg US Long Treasury Total Return Index

- Bond Investor: 100% in Bloomberg US Long Treasury Total Return Index

- Reactionary Investor: Invests 100% in S&P 500 Index. Moves 100% in 90-Day T-Bills each time the market drops 30% and then moves back to 100% in S&P 500 Index two years later.

- Cash Investor: 100% in 90-Day T-Bills

Note that you can’t directly invest in the S&P 500, which is a benchmark of the market, but it can be mimicked through investing tools.

Let’s see how each of our investors did by the end of 2021:

- Equity Investor: This investor saw all six big drops, and $10,000 is now nearly $5 million

- Balanced Investor: This investor saw all six big drops, and $10,000 is now $2.5 million. They weren’t trying to hit a home run, but they weren’t on the sidelines either.

- Bond Investor: $10,000 is now $834,000

- Reactionary Investor: $10,000 is now $550,000

- Cash Investor: 100% in 90-Day T-Bills $141,956

It’s generally understood that going all cash equivalents and jumping in and out of the market may make an investor feel calmer or more in control; however, based on historic market patterns, it’s clear market timing is a poor strategy, at best.

This is a hypothetical example and is not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing.

Now For Some Good News

Warren Buffet once said, “Never vote against America’s economy.” And author Nick Murray said, “Great companies are not an asset class but a solution.”

Despite the never-ending parade of dire news, amazing innovations are taking place. Scientists at MIT have created a new form of plastic that is two times stronger than steel under load testing. Researchers at the California Institute of Technology are working on a brain-reading device to help paralyzed people move, talk, and touch.

These are amazing, world and life-changing innovations created by the brightest minds in the world, and the free market will allow these innovations to reach the public. The metaverse will create new markets as the iPhone has done via new software that we call apps. I can open my phone and check the price of my house on Zillow, refill prescriptions at Walgreens, and check in for my flight on Delta. My daughter and I play head or tails on an app called Flip A Coin.

Companies are resilient and innovative and huge drivers for your long-term income needs. At Paradigm Wealth Partners, we’re not thinking of stocks when we invest; we’re thinking of companies. We invest in companies that we believe in, primarily dividend-paying companies whose dividends grow year after year.

Dividends aren’t guaranteed; companies can decrease them or stop paying them. But we monitor that and build portfolios with companies that are resilient and find ways to increase dividends and have done so for decades. Those companies drive change and seek to provide income for retirement that resists inflation with a source of passive income.

The Case for Long-Term Investing

Since 1929, there have been 26 bear markets, markets that are down 20% or more from a recent high. And there have been 26 bull markets, markets that are up 20% or more from recent lows. A bear for every bull going back nearly a century! Every time, a recovery. Every, single time.

I know it’s hard sometimes. In March of 2020, the market dropped between 6-12% in a single day several times. One day the Dow was down 2,000 points, and the very next day, it was up 2,000 points. It’s traumatic to hear that we’ve had the worst day ever, and then the following day, we’ve had the best day ever in terms of market point moves.

We think by being proactive and moving to cash, we’re making a good choice, but it’s usually too late when we do it. And then we have a whole new problem. When do we get back in? We typically get that wrong, too; we wait too long and miss the recovery.

We often think, “But it’s different this time,” when we hear about the latest crisis. Inflation is different this time. The recession is different this time. The terror attack is different this time. But it’s never different. Things happen, the market panics, and then the market readjusts.

So how can we make decisions and think in a long-term way so we are in a position to take advantage of future growth?

Turn off the TV, and focus on your core dreams and values. Spend time with your family and friends, and enjoy your hobbies. Those are the places where your focus should be. Maintain your perspective.

And meet with your financial advisor. It’s times like these when I think advisors really prove their value to their clients. An advisor can help you determine the appropriate risk tolerance for you and your portfolio so you can Create The Life You Love.

If you have any questions, reach out to me. And check out my new YouTube channel. The videos are short, walk and talks, where I take a stroll and talk about whatever’s on my mind.

Listen to the Full Episode:

What You’ll Learn In Today’s Episode:

- Why you should never sell in a market downturn.

- The benefit of not selling in a panic.

- Why losing money is so much more painful than the pleasure of gaining money.

- The importance of focusing on your core values instead of the news.

- Why you shouldn’t get your investment advice from the television.

Ideas Worth Sharing:

“When we’re anxious, we’re more likely to allocate our attention to negative information.” – Jonathan Bednar

“You don’t see cash balances going down in value as you might see in bonds or equities.” – Jonathan Bednar

“The pain of losing money—psychologically—is about twice as intense as the pleasure of gaining it.” – Jonathan Bednar

Resources In Today’s Episode:

- Jonathan Bednar: Email | Twitter | LinkedIn

- The Price of Panic

- What The Wealth?! by Jonathan Bednar

Enjoy the show? Use the Links Below to Subscribe: