Today’s episode focuses on QCDs as a tax planning strategy, and we’re joined again by Katie!

What is an RMD?

While the main focus of today’s episode is QCDs, qualified charitable distributions, to understand QCDs, we have to first discuss RMDs, required minimum distributions.

RMDs are required for those aged 72 or older. The previous age was 70 ½ but was raised a few years ago. Those aged 72 and up who are retired must withdraw a certain amount of money from their IRAs and 401(k)s each year. Contributions made were not taxed and gave investors a tax deduction. But now, the IRS wants its money, and the withdrawals are taxed.

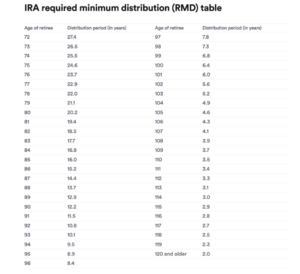

The IRS provides a table for RMDs:

To calculate your RMD, divide the year-end value of your IRA or 401(k) by the distribution period value that matches your age on December 31st each year. Each year starting at 72 has a corresponding distribution period, so you must calculate your RMD every year.

At age 72, you need to take an RMD of roughly 3.5%, and the older you get, the more you have to withdraw in percentage terms.

Potential Update to RMD Rules

Under the Security Act, Congress raised the RMD age from 70 ½ to 72. There is now a Security Act 2.0 that would increase the age to 75. The bill has wide bi-partisan support, has passed the House, and is waiting to be brought before the Senate, where it’s expected to pass.

The RMD age will be raised in stages over a period of ten years:

- The age will rise from 72 to 73 for those who turn 73 after December 31, 2022, and before January 1, 2030. If the bill passes this year, the change will go into effect in 2023.

- The next jump will be to 74 for those who turn 73 after December 31, 2029, and before January 1, 2022.

- The final jump will be to 75 for those who turn 74 after December 31, 2032.

What is a QCD?

A QCD or qualified charitable deduction is a tax planning strategy you can use to satisfy your RMD and your charitable giving goals. A QCD allows you to make direct contributions to qualifying charities via withdrawals from your retirement accounts, and that money satisfies your RMD requirement:

- The strategy is available to those aged 70 ½ and older

- There is a limit of $100,000 per year from an IRA

- The contribution must be made by December 31 of the respective tax year

- The money must be classified as a direct transfer. It can’t go from the account to the account holder and then to the charity. The custodian of the IRA must send a check directly to the charity.

- The types of IRAs that can be used are Traditional, inherited, SEP, and SIMPLE

- Entities, including donor-advised funds, private foundations, and supporting organizations, don’t work with the QCD strategy; the money must go directly to the charity to be eligible.

Advantages of QCDs

QCDs can lower your AGI, adjusted gross income, when you don’t need your RMD to pay expenses. A QCD can move you to a lower tax bracket, which may lower your Part B premiums for those on Medicare.

QCDs are a flexible tax-planning tool. If you have a significant taxable event in a given year, you can use a QCD to help offset it, but you don’t have to use it year after year; it’s there when you need it.

Disadvantages/Limitations of QCDs

QCDs don’t really have disadvantages, but they do have a few limitations:

- You must be at least 70 ½ to use them

- The limit is $100,000 per year

QCDs aren’t for everyone. If you need your RMD for living expenses, QCDs aren’t an option. That’s okay, not all tools work for everyone, but it’s still good to be aware of them.

If you have any questions about QCDs or any other areas of financial planning, reach out to me. You can find Katie here.

And check out my new YouTube channels. The videos are short, walk and talks, where I take a stroll and talk about whatever’s on my mind. And I have a Paradigm Wealth Partners channel too.

Advisors associated with Paradigm Wealth Partners may be either (1) registered representatives with, and securities offered through LPL Financial, Member FINRA/SIPC, and investment advisor representatives of Paradigm Wealth Partners; or (2) solely investment advisor representatives of Paradigm Wealth Partners, and not affiliated with LPL Financial. Investment advice offered through Paradigm Wealth Partners, a registered investment advisor. Paradigm Wealth Partners is a separate entity from LPL Financial.

Katie Kavehrad is solely an investment advisor representative of Paradigm Wealth Partners, and not affiliated with LPL Financial.

Listen to the Full Episode:

What You’ll Learn In Today’s Episode:

- What an RMD is and who it applies to.

- How to figure out how much your RMD is.

- The updates to the RMD rules.

- What QCDs are and why they are useful.

- When QCDs start and the benefits involved.

Ideas Worth Sharing:

- “Once you reach age 72, you must begin taking distributions out.” – Jonathan Bednar

- “QCDs are a way to make charitable donations to qualified charities and have that money count toward your RMD distribution.” – Katie Kavehrad

- “QCDs lower your adjusted gross income – which can in-turn lower your tax bracket.” – Katie Kavehrad

Resources In Today’s Episode:

- Katie Kavehrad: LinkedIn

- Jonathan Bednar: Email | Twitter | LinkedIn

- What The Wealth?! by Jonathan Bednar

Enjoy the show? Use the Links Below to Subscribe: